Hotel Karibia Medan, 2-4 Juni 2016

Training ini diikuti oleh kurang lebih 40 orang peserta yang berasal dari Perguruan Tinggi di Sumatera Utara.

KEUANGAN KEWIRAUSAHAAN (ENTREPRENEURIAL FINANCE)

Entrepreneurial Finance examines the elements of entrepreneurial finance, focusing on technology-based start-up ventures and the early stages of company development. The course addresses key questions which challenge all entrepreneurs: how much money can and should be raised; when should it be raised and from whom; what is a reasonable valuation of the company; and how should funding, employment contracts and exit decisions be structured. It aims to prepare students for these decisions, both as entrepreneurs and venture capitalists. In addition, the course includes an in-depth analysis of the structure of the private equity industry.

Requirements

The course requires the concepts and skills developed in Finance Theory II, which is a pre-requisite. Other courses that may fulfill the pre-requisite requirements are Financial Management or Finance Theory. Some knowledge of option pricing will also be needed in a few instances. Because we will be linking financial concepts to other business concepts your broad MBA training will also come in handy.

This course places a strong emphasis on presentation and discussion skills. It will be important for you to explain your positions or arguments to each other and to try to argue for the implementation of your recommendations.

Course Overview

This course will use a combination of case discussions and lectures to study entrepreneurial finance. The course is targeted to budding entrepreneurs and venture capitalists. There are five main areas of focus:

1. Business Evaluation and Valuation: Here we will give you some tools to valuate early stage business opportunity. We will also review the standard tools of valuation applied to start-up situations and introduce the venture capital method and the real options approach to valuation.

2. Financing: In this module, we will highlight the main ways that entrepreneurs are financed and analyze the role of financial contracts in addressing information and incentive problems in uncertain environments.

3. Venture Capital Funds: We will look at the structure of venture capital funds and their fund raising process. This module will include issues of corporate venture capital and private equity funds in emerging market economies.

4. Employment: We will study the issues of attracting and compensating employees in start-ups.

5. Exit: We will discuss how founders should exit. Should they sell to another company, take it public, or continue independently as a private company?

Carl Stjernfeldt (General Partner at Castile Ventures) will co-teach a number of sessions. We are very lucky to have Carl participate so please use his time judiciously! We also have a number of additional guest speakers who will discuss recent developments in the industry.

Materi Pokok yang disampaikan oleh Nara Sumber ada 4 Topik, yaitu:

1. Start up business

2. Financial Audit

3. Financial Strategic

4. Exit Strategic

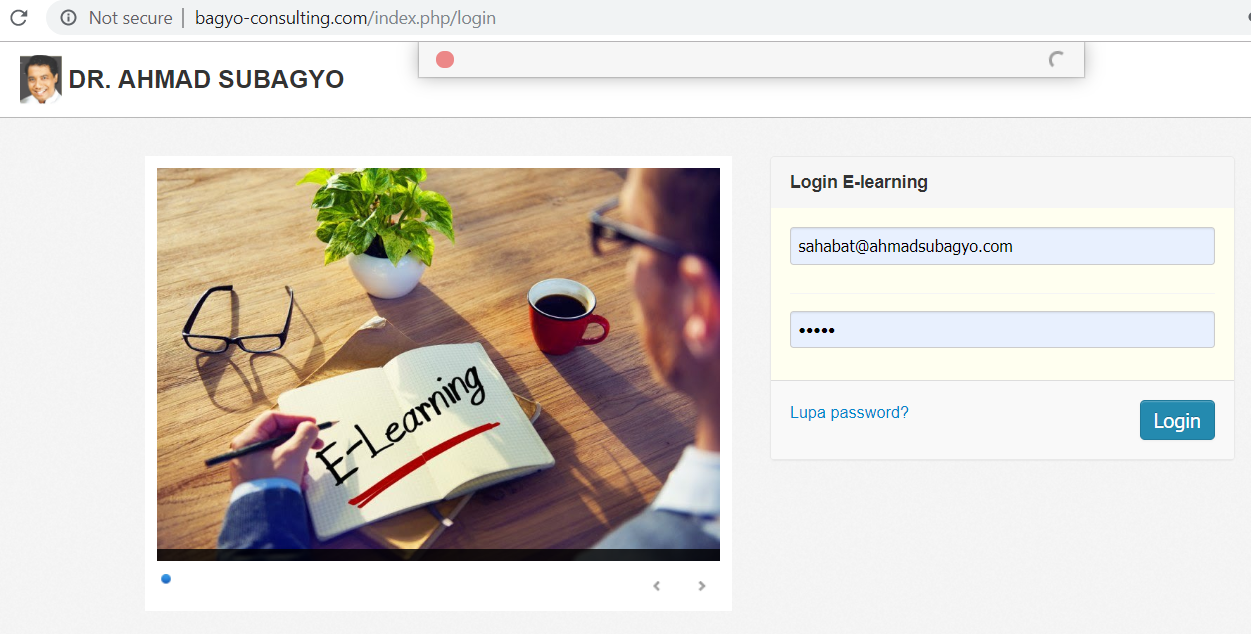

Berikut dokumentasi dan sebahagian modul yang dapat anda unduh!

Modul Business Plan

Speak Your Mind